Mpowa Finance Loan Summary

Mpowa Finance is South African fintech lender founded in 2011. Mpowa primarily focusses on Payday loans ranging from R100.00 to R8,000.00. Mpowa loans charge interest of 0.17% per day, initiation fee of R165 plus VAT on loan amount up to R1000.00, thereafter 10%.

How Mpowa Finance Payday Loans work?

Even though payday loans are relatively new among South Africans, such as the MPOWA Finance payday loans, statistics reveal that they are in high demand in South Africa.

Our research has confirmed that about 67% of cases dealt with by the debt counsellors are connected to payday loans. This points out the need to review these lenders so as to have a clear picture of what to expect whenever you take up such a loan.

Mostly, people take up these loans to cushion unexpected financial difficulties and to harness situations where a quick cash injection is needed. Therefore, it is very important that you educate yourself about them and gain knowledge about different products on offer.

In this article, we give you a review on the cash loan product offered by Mpowa Finance. We believe that this review together with other payday lenders’ reviews such as Lime24, CashLoan and Boodle loans we have published, will assist you to make informed decisions when taking up a loan.

Nowadays, no one wants to fill in long application forms just to get a short loan to take them to the next payday. That is why lenders like MPOWA Finance are in demand since their essence is in online loans.

Eligibility

- Have an Identity Document of the Republic of South Africa

- Be over 18 years old

- Have a South African bank account and access to the internet

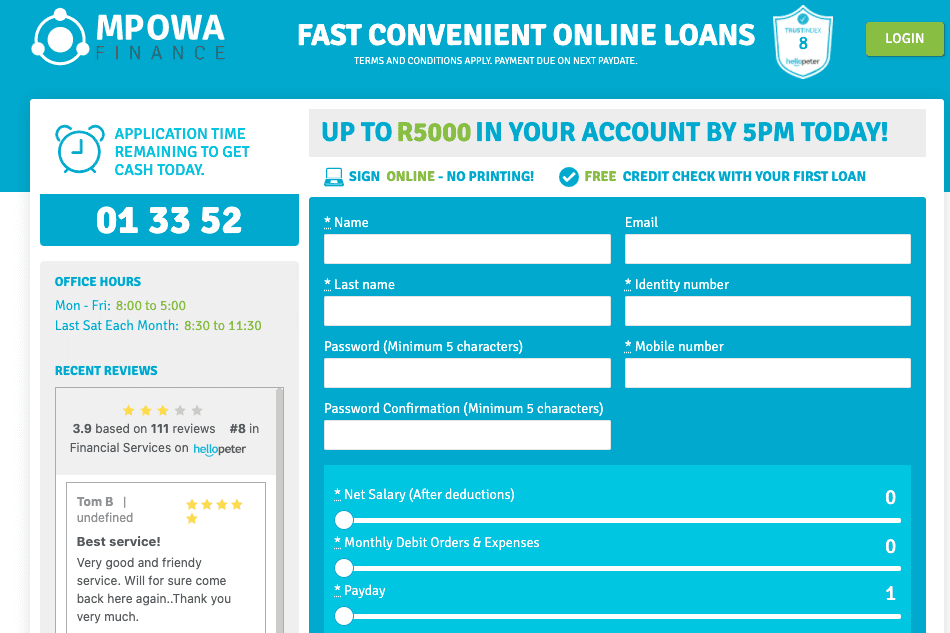

Mpowa Finance Application Process

Step 1

You create your account online by providing them with your personal details and contact details. Creating your account takes an average of 2 minutes or even lesser.

In the form, you will have to state your salary after monthly deductions, payday and the total amount of your debit orders and expenses.

Should you create an account and complete the loan application form by 3 PM, you will receive a loan contract and the decision immediately.

Step 2

Rectify and sign your documents online, then upload your latest 3 months bank statements or your payslips for the recent 3 months.

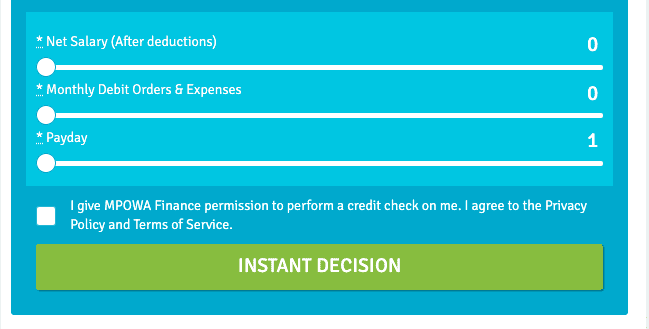

MPOWA Finance uses the information you provide them to perform a credit check. You should provide information out of good faith since it is used to come up with a decision.

Step 3

MPOWA Finance will then call you for a voice recording over your contract details. When approved, MPOWA Finance pledges to make an immediate cash deposit into your account by 5 PM on the very day of approval.

Possible loan amount you can get

Usually, payday loans are meant to cover the financial shortfalls you may have before your next payday. The loan amount offered also reflects its purpose, with MPOWA Finance, you are able to access a loan from R500 to R5 000.

Once you’re approved for the loan, the money will be deposited into your bank account by 5 PM the same day.

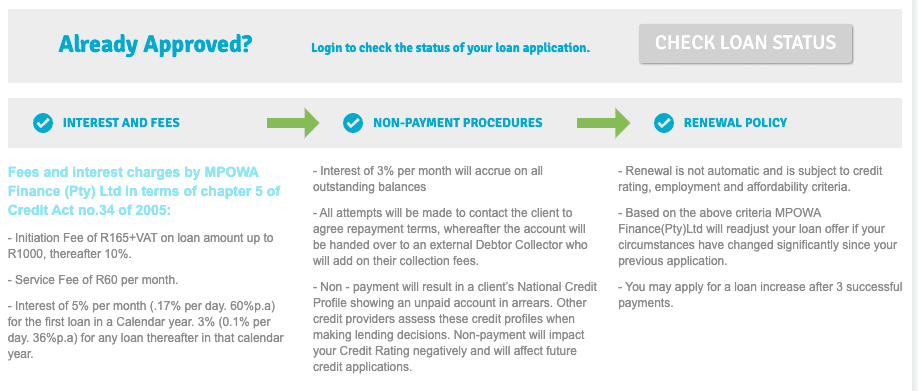

Interest and fees charged

There’s a R165 origination fee (excluding VAT) for loans up to R1000. For loans exceeding R1000, the origination fee is 10% of the loan amount.

MPOWA Finance also imposes a monthly service fee of R60.

For your initial loan with MPOWA, you’ll face a 5% monthly interest rate, equivalent to 0.17% daily and 60% annually. This “first time” condition refers to the initial loan taken within a calendar year.

Subsequent loans within the same calendar year will incur a 3% monthly interest rate.

Nonpayment procedures

Failure to honour your loan obligation, a 3% interest per month will accrue on all your outstanding balances.

MPOWA Finance will make possible attempts to contact you so as to discuss repayment terms. Should that fail, your account will be handed over to an external Debtor Collector who also charges collection fee.

We always emphasize that clients should honour their loan obligations because delaying or not paying your loans back affects your credit profile. Lately, online lenders have adopted the procedure of checking clients credit profiles to come up with a decision over loan applications.

Loan renewal policy

To take another loan MPOWA Finance does another credit rating and also assesses your employment and affordability criteria. Therefore you must not expect renewal to be automatic.

Based on the assessment outcome MPOWA Finance may re-adjust your loan offer even up to R5000. This is only possible if your circumstances have positively changed since your previous application.

Competitive Advantages of MPOWA Finance

- The application process is convenient since it is completely done online without any paperwork.

- There is a free credit check with your first loan. Also, paid-up loans improve your credit score since MPOWA Finance updates with the credit bureau.

- The decision is fast and approved loans are deposited the same day.

Competitive Disadvantages of MPOWA Finance

- Fees charged are high; also quoting monthly service fees on a one month loan is an unnecessary cost.

- The information we gathered from Hellopeter, a client review site reveals how most clients complain about poor services and lack of communication.

Conclusion

MPOWA is a place where you can get a fast loan to cover small expenses. It is fast and requires just a few things to process your application. MPOWA has serviced a lot of clients by helping them cover immediate finances when they were short of money. Hence you can try it out as well if you are in need of a small cash injection.