- The South African Reserve Bank (SARB) has established the country’s first deposit insurance organization, the Corporation for Deposit Insurance (CODI), to protect bank depositors and enhance confidence in the financial sector.

- CODI will administer a deposit insurance fund and educate depositors on the benefits and limitations of the scheme, with secondary legislation outlining coverage limits set to be published in 2023.

- The establishment of CODI is part of SARB’s broader efforts to modernize and align with international financial standards, reinforcing trust in South Africa’s banking institutions and promoting financial sector growth.

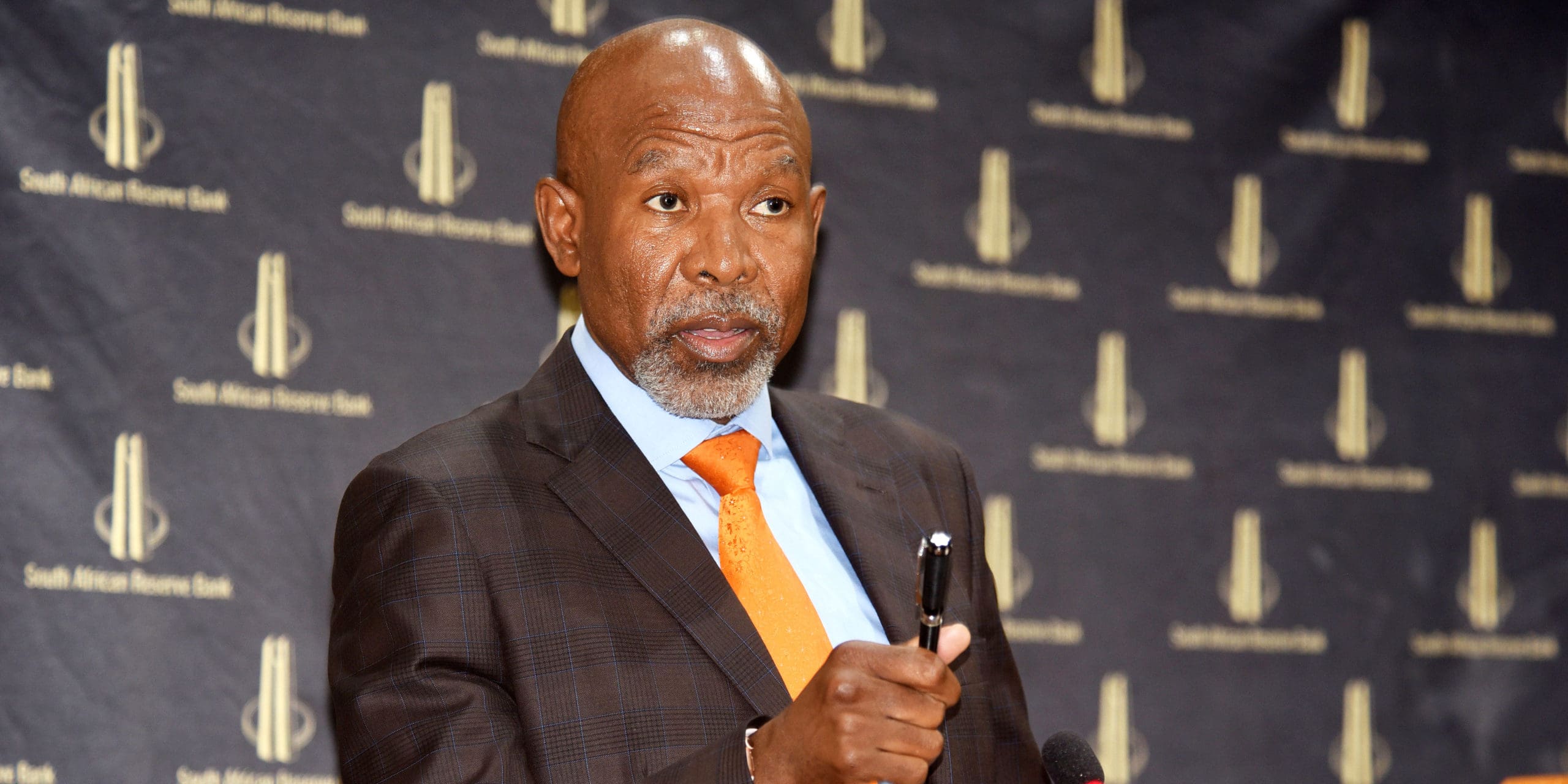

The South African Reserve Bank (SARB) has taken a significant step towards bolstering the country’s financial sector by establishing its first deposit insurance organization, the Corporation for Deposit Insurance (CODI). Launched as a legal entity on March 24, 2023, CODI aims to protect bank depositors and instill greater confidence in South Africa’s financial institutions.

A central bank deposit insurance scheme, such as the one CODI will administer, guarantees repayment of deposits up to a specified amount in case of a bank failure. The formation of CODI was made possible by Finance Minister Enoch Godongwana as part of the implementation of the Financial Sector Laws Amendment Act. This Act endowed the SARB with the authority to act as a resolution body and to establish the deposit insurance organization.

SARB has emphasized that CODI aligns with its ongoing focus on maintaining financial stability and enhancing confidence in South Africa’s banking sector. The new body seeks to bring the nation in line with international financial standards and practices by adhering to the principles set forth by international standard-setting bodies.

CODI’s chief responsibilities include the creation, maintenance, and administration of a deposit insurance fund designed to safeguard covered depositors. The organization will also educate depositors on the benefits and limitations of the insurance scheme in the event of a bank resolution. In addition, CODI is working on developing secondary legislation that outlines the coverage limits for depositors. This legislation will undergo the parliamentary process and be published by the National Treasury in 2023, paving the way for CODI to become fully operational in 2024.

Although CODI operates as a statutory body and a subsidiary of the SARB, it maintains an independent board responsible for managing and overseeing its activities. In preparation for the deposit insurance scheme’s implementation, CODI has collaborated with South African financial institutions, other stakeholders, and the World Bank.

The SARB’s move to establish CODI forms part of its broader efforts to modernize and align with international standards. Under its Vision 2025 initiative, the Reserve Bank is researching and reviewing existing regulatory frameworks, developing new frameworks in accordance with international standards and principles. The SARB has stated that the creation of CODI stems from regulatory reforms initiated in response to the global financial crisis.

The establishment of CODI supports the SARB’s mandate to protect and enhance financial stability by closely monitoring the financial environment and mitigating systemic risks that could potentially disrupt the nation’s financial system. This significant development is expected to reinforce trust in South Africa’s banking institutions and promote financial sector growth in the country.