European fintech startup Finom has secured a significant boost in its expansion efforts with a successful Series B funding round, raising €50 million (approximately R1.026 billion) in equity. This latest investment underscores the growing demand for financial services tailored to small and medium-sized enterprises (SMEs) and freelancers, highlighting a shift away from traditional banking models.

Funding Round

Finom, founded in the Netherlands in 2019, specializes in providing online banking services targeted at SMEs and freelancers. The Series B funding round, co-led by new investor Northzone and existing investor General Catalyst, marks a major milestone for the company.

Market Context

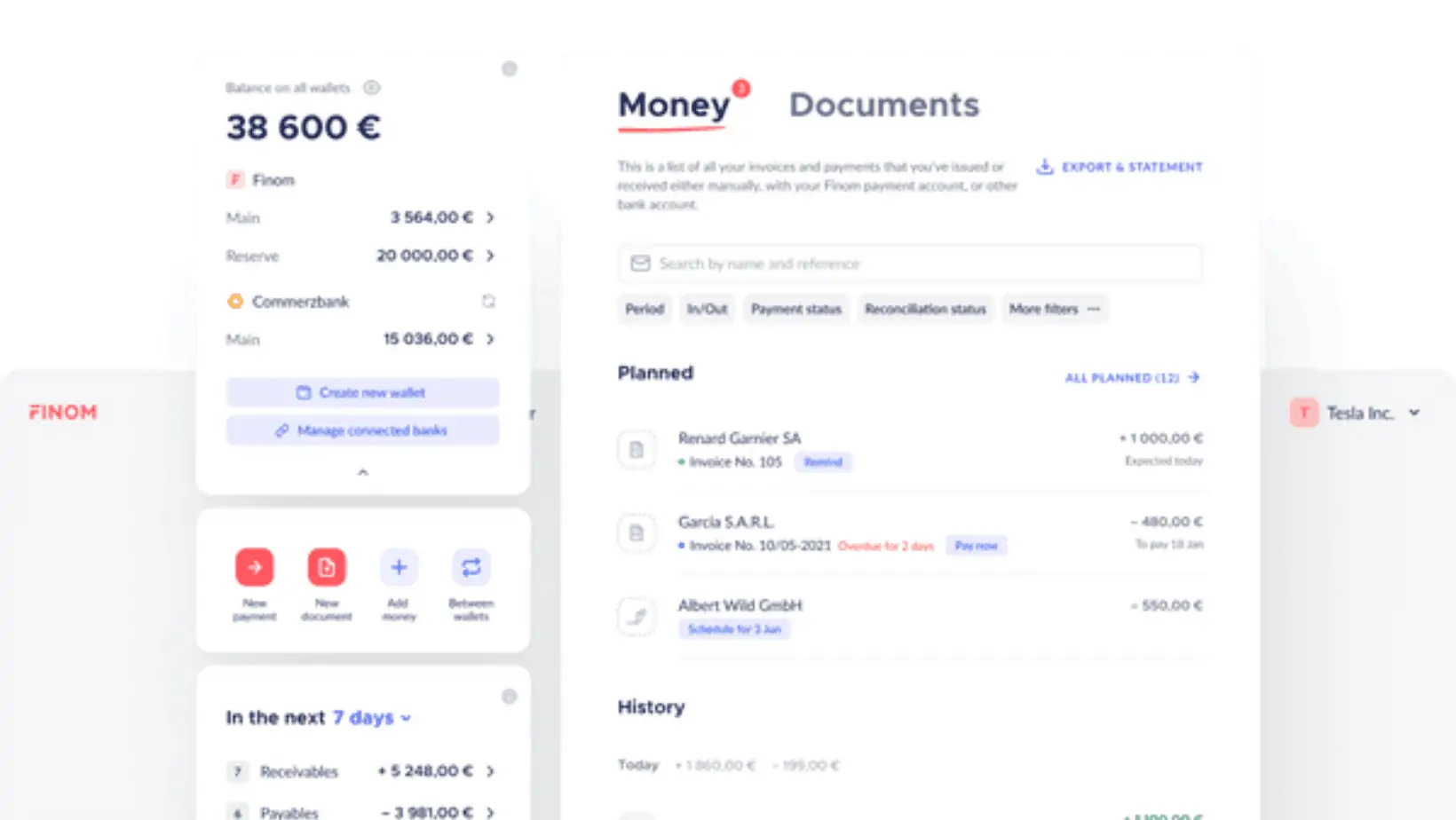

The funding round highlights the increasing demand for innovative financial solutions tailored to the unique needs of SMEs and freelancers. Traditional banking institutions often struggle to adequately serve this market segment, leaving room for challenger banks like Finom to fill the gap. With its focus on providing integrated banking, payments, invoicing, and expense management solutions, Finom aims to streamline financial processes for its customers.

Regulatory Landscape

Operating under an Electronic Money Institution (EMI) license rather than a traditional banking license, Finom is positioned to offer a wide range of banking-like services across the European Union. While the EMI license restricts the company from providing lending services, it enables Finom to deliver essential financial tools and services to its customers.

Expansion Plans

Buoyed by the latest round of funding, Finom is poised to accelerate its expansion efforts. The company currently serves approximately 85,000 customers across Germany, Spain, France, Italy, and the Netherlands. With plans to target the entire Eurozone by the following year, Finom aims to localize its services for additional markets in the coming months. The infusion of funds will support these expansion initiatives and further solidify Finom’s position in the competitive fintech landscape.

Investor Confidence

Notable investors in the Series B round include General Catalyst, known for backing successful startups such as Airbnb, Stripe, and Snap. The participation of established venture capital firms underscores the confidence in Finom’s business model and growth potential. Additional participants in the round include Target Global, Cogito Capital, Entrée Capital, FJLabs, and S16vc, further highlighting the widespread interest in Finom’s innovative approach to SME banking.

Conclusion

The successful Series B funding round represents a significant milestone for Finom as it continues to disrupt the traditional banking sector with its tailored financial solutions for SMEs and freelancers. With substantial investment backing and ambitious expansion plans, Finom is well-positioned to capitalize on the growing demand for innovative banking services across the Eurozone and beyond.

This website uses cookies.