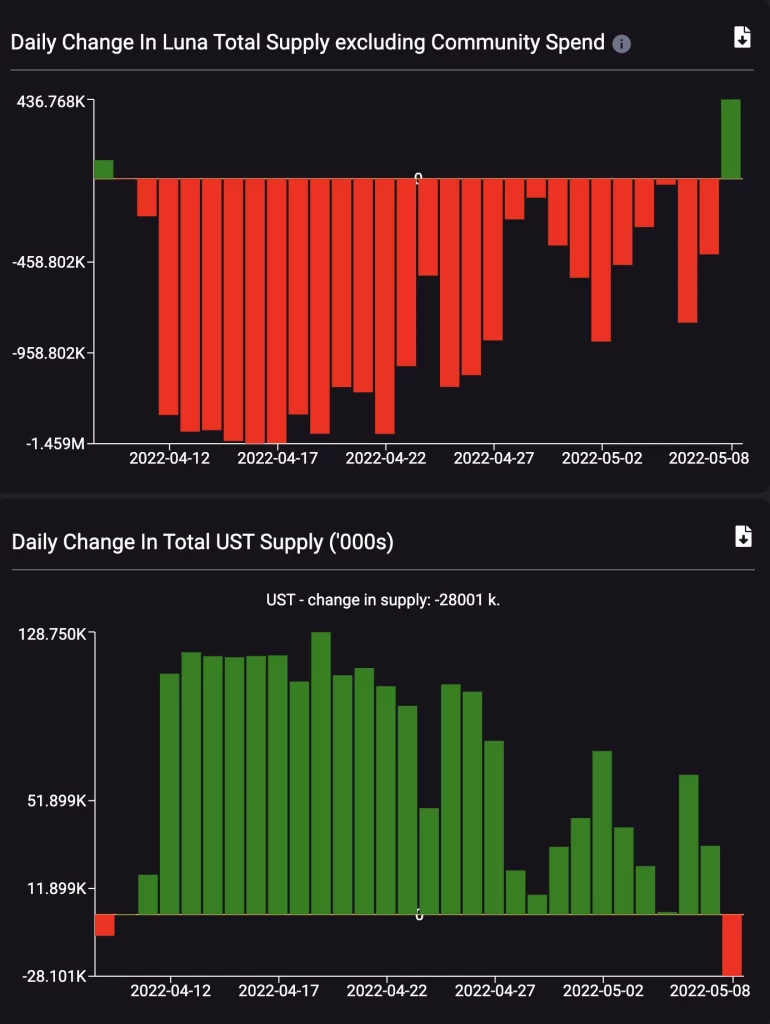

Excess Terra supply, combined with UST supply contraction, is causing LUNA prices to fall. Terra (LUNA) has plummeted following a FUD attack on its native stablecoin TerraUSD (UST).

The LUNA/USD pair fell 20% on May 7 and May 8, reaching $61(R 985), its lowest level in three months after a whale unloaded $285 million (R4.6bn) in UST. Because of this selloff, UST momentarily lost its peg to the US dollar, plunging as low as $0.98 (R15.92).

Excessive LUNA supply

According to Terra’s elastic monetary policy, LUNA acts as a collateral asset to keep UST’s dollar peg. As a result, when the value of UST exceeds $1.00 (R16.14 ), the Terra protocol encourages users to burn LUNA and mint UST. When the price of UST falls below $1.00 (R 16.14), the protocol compensates users for burning UST and minting LUNA.

As a result, LUNA’s worth should fall as UST supply is reduced. Similarly, as UST supply expands, LUNA’s valuation rises, according to Will Comyns, a Messari researcher.

The chart below depicts an ongoing downward trend in daily UST supply, which corresponds to a relative increase in daily LUNA supply. For the first time in two months, the UST market contracted on May 8, falling by 28.1 million below zero. At the same time, LUNA’s supply increased by over 436.75 million over zero. The enormous daily supply in the face of what appears to be declining or stable market demand may have pushed LUNA’s price lower.

Is Terra in for more suffering?

Because of Terra’s continuous price decrease, LUNA retested a support confluence comprised of its 50-day exponential moving average (50-day EMA; the red wave) near $56 (R 910) and a multi-month upward sloping trendline.

Interestingly, the ascending trendline forms a rising wedge pattern when combined with another upward trending line above. Rising wedges are bearish reversal settings, and their presence on Terra’s weekly chart indicates that additional downside is likely.

A rising wedge breakdown lowers the price by the maximum distance between the structure’s upper and lower trendlines, according to technical analysis.

Thus, if LUNA falls below its wedge from its current support confluence, accompanied by an increase in volumes, its price might fall to roughly $22.50 (R 366), a drop of more than 60% from its current level.

A bounce from the support confluence, on the other hand, would have positioned LUNA for a run-up to the wedge’s upper trendline and a new record high above $130 (R2 112 ).