Assupol is a company that is known for offering products that are of value at a low cost. Assupol savings plans are no exception; they can be tailor-made to suit anyone’s savings needs. The savings plans from Assupol do not discriminate; anyone can open one of the four Assupol Savings Plans at any time.

Before you rush to open one, you may find it useful to first go through this article. It gives you an in-depth overview of the Assupol Savings plans and all that comes with them. In this article, you will find details about all four options, their advantages and disadvantages.

Assupol Savings Plans offer four savings options for different types of investors. The lowest premium on a savings account is R300.00 per month. The minimum term for savings for all savings accounts is 5 years.

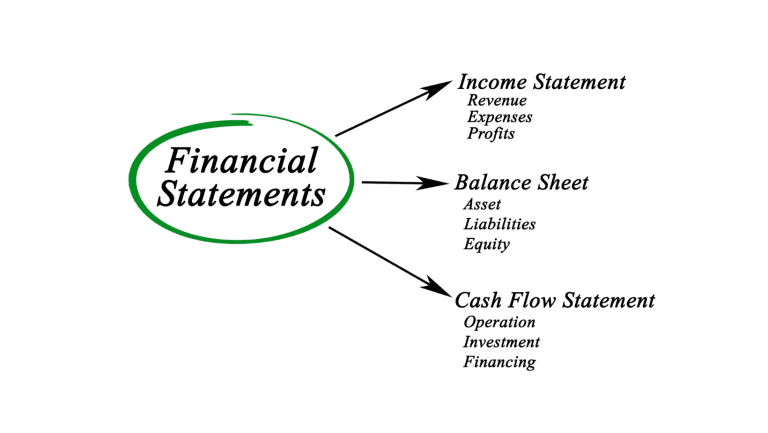

When investing or saving your money with Assupol, you need to ensure that you understand how your earnings will be paid out. Different savings options offer different payouts, with some offering a payout at maturity, others offering a guaranteed income, and more.

Assupol Savings Plan Account Options

There are four savings accounts available from Assupol. Savings accounts include:

- Assupol One Savings Policy,

- Assupol One Tax-Free Savings Policy,

- Guaranteed return Single premium policy, and

- Guaranteed income single premium plan.

In this chapter, we will discuss all the Assupol savings plan accounts that are available in detail and what the benefits of each are.

Assupol One Savings Account

Of all the Assupol Savings Plans, one savings account has the most lenient minimum amount required to open an account at Assupol. Clients can open the Assupol One Savings account by simply making a deposit of R300.00. The account requires that clients make monthly premium deposits of at least R300.00.

A deposit of at least R5,000.00 is required for clients that want to make a single premium. However, this is optional. The minimum term of investment on the Assupol One Savings Account is 5 years and there is no maximum term. Therefore, clients can save their money for over 5 years.

Yearly premiums can be increased on the Assupol One Savings Account. The yearly premium increase can be up to 20% of the premium value. This savings account can be used as a security for loans and can be ceded.

Assupol One Tax-Free Savings policy

Assupol One Tax-Free Savings Account is a tax-free savings account and, as such, it adheres to the specifications and requirements of a tax-free savings account as per SARS. The Assupol One Tax-Free Savings policy has the following implications:

- Contributions toward the account are limited to R36,000.00 per tax year,

- Any contributions exceeding the annual cap will be taxed at 40%. ,

- Unused amounts will not be rolled over to the next tax year, and

- Lifetime contributions to this account may not exceed R500,000.

The account has a minimum savings option of R300.00 per month. This money should be deposited every month for at least 5 years. There is no maximum savings term on this account, meaning clients can save their money for more than 5 years.

Since the contribution cap per tax year is R36,000.00, Assupol gives clients an option to save R5,000.00 per month.

or R36,000.00 per tax year to capitalize on the contribution limitations. These contributions have a minimum term of 5 years, with no maximum term on the savings option.

The Assupol One Tax-Free Savings Account allows yearly premiums to be increased by up to 20% per tax year. Withdrawals are allowed on this account and can be done from the first year of the policy.

Capital gains tax is not applicable to this account. Other taxes that are not applicable include dividend tax. Note that this account cannot be used as security for a loan or be ceded for any reason.

Guaranteed Return Single Premium Policy

The Assupol Guaranteed Return Single Premium Policy requires a minimum deposit of R30,000.00. This premium payment is a single payment that will be kept in the account for the entire duration of the investment. The minimum term on the account is 5 years. Should one opt to keep their money for over 5 years they are allowed to do so. However, the term should not exceed 7 years.

Once taken, the Guaranteed Return Single Premium Policy cannot be paid up before the maturity date. Therefore, clients need to be sure that they won’t need the capital during the term of the investment. The good thing is that the policy can be used as security for a loan and can be ceded. Therefore, you can leverage this account. The value of the savings account is guaranteed after maturity, which is usually between 5 and 7 years.

Guaranteed Income Single Premium Plan

The Assupol savings account is designed for those who want to earn a return on their savings investment. However, this account requires more money to be deposited in it than all other savings accounts offered by Assupol. To open the account, you need to deposit at least R1,000,000.00.

Since interest rates on savings accounts are agreed upon before making an initial deposit, one can structure a Guaranteed Income Single Premium Plan that is able to pay all their expenses. This may require more capital, but the higher the amount and the longer the savings period, the higher the interest rates will be.

The account offers a guaranteed monthly income, however, capital cannot be withdrawn at any period except at the maturity date. The minimum savings period is 5 years, and the maximum period to save is 7 years.

Conclusion

Assupol savings plans may not be revolutionary, but they accommodate every type of investor. Some of the plans allow account holders to leverage their money by using their accounts as collateral.

Knowing exactly why you need a savings account will help you choose a savings account with Assupol. You can always have more than one savings account if you have more than one saving need.

For more details on Assupol savings plans visit the Assupol Official Website: www.assupol.co.za